Sources close to Dave King reveal if bid incoming for Rangers shares after Club 1872 development

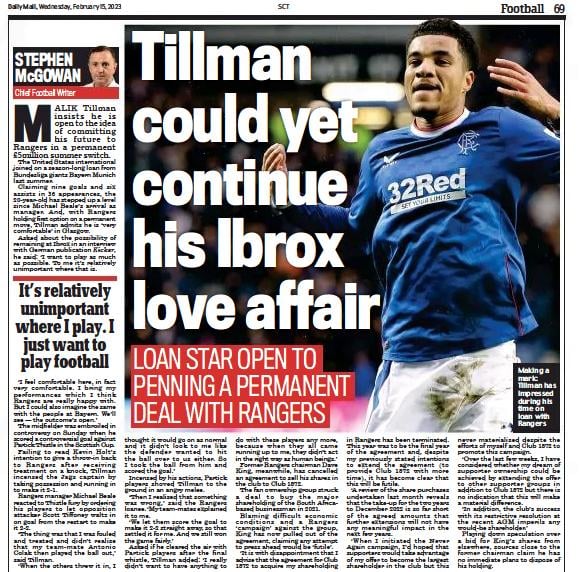

Sources close to former Rangers chairman Dave King claim he has no immediate plans to dispose of his holding after he withdrew from his agreement to sell his major shareholding in Rangers to Club 1872, according to the Scottish Daily Mail.

The former Ibrox chairman struck a multi-million-pound deal with the supporter body to transfer his stake in Rangers International Football Club PLC in December 2020.

However, it was revealed in The Herald [14 February], that slow uptake from the supporter members forced King to cancel the initiative and the remainder of his 14.47 per cent shareholding will remain in the ownership of New Oasis Asset Limited.

According to the Scottish Daily Mail [15 February, pg 69], speculation over a bid for King’s shares from elsewhere has been played down and sources close to the club’s former chairman claim he has no immediate plans to dispose of his holding after the failed agreement.

Major blow

After planning for three years to secure the agreement to own a stake in the football club, these developments come as a major blow for Club 1872, especially after King expressed his hope that supporters would make the most of their chance to own a major stake in Rangers.

The move from the supporters’ body was indeed brave and ambitious but one which could well have been achieved had all parties been on the same page all throughout.

The opportunity King offered was certainly a once in a lifetime, one which will have changed the course and perceived notions of fan ownership in the UK.

It will have offered fans a chance to control the interests of Rangers rather than having to rely on individuals who potentially have no knowledge of the club at all.

A huge dream looked like it will have been achieved but now it’s been snatched from the supporters’ hands, and it remains to be seen whether such a grand opportunity such as this could present itself again.

In other Rangers news, the Ibrox bank is set for a cash boost after a document emerged on Wednesday.